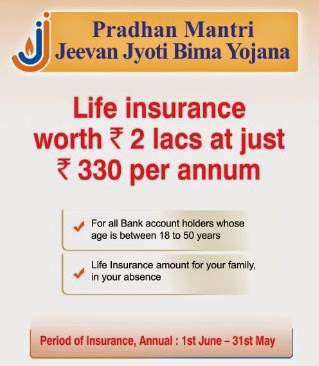

Pradhan Mantri Jeevan Jyoti Bima Yojana

Central government announced insurance scheme Pradhan Mantri Suraksha Bima Yojna (for Accidental Death and permanent disability), Pradhan Mantri Jeevan Bima Yojna (for life insurance) and Atal Pension Yojna (for pension). This schemes are aimed at providing affordable universal access to essential social security protection in a convenient manner linked to auto-debit facility from the bank account of a subscriber.

Highlights of the scheme Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY - Scheme 2 - for Life Insurance cover)

The scheme will be a one year cover, thereafter renewable every year. The scheme known as Pradhan Mantri Jeevan Jyoti Bima Yojana, would be offering life insurance cover for death due to any reason. The scheme would be offered / administered through Life Insurance Corporation of India (LIC) and other Life Insurance companies willing to offer the product on similar terms with necessary approvals and tie up with Banks for this purpose. Participating banks will be free to engage any such life insurance company for implementing the scheme for their subscribers.

Eligibility - All savings bank account holders of the Participating Bank in the age group between 18 years (completed) to 50 years (age near birthday) who have given consent to join the scheme / enable 'Auto Debit' as per the modality, will be enrolled into the scheme.

Enrollment Modality / Period - The cover shall be for the one year only starting from 1st June to 31st May for which option to join / pay by 'Auto Debit' from the designated savings bank account on the prescribed form will be required to be given by 31st May of every year, extendable up-to 31st August. Those joining subsequently may be able to do so with payment of full annual premium for prospective cover, with submission of a self-certificate of good health in a acceptable form.

Premium - Rs 330/- per annum.

Payment Mode - The premium will be directly 'Auto-Debit' by the bank from the subscribers' savings bankn account. This is the only mode available currently.

Risk Coverage - Sum Assured of Rs. 2,00,000/- on the death of the Insured member for any reason is payable to the Nominee. No claim is admissible for deaths during the first 45 days from the entry date, except for the cause of death due to accident.

Termination of assurance -

1) Account holder attains age of 55 years.

2) Closure of account with the Bank or insufficiency of balance for debiting premium.

3) In case of multiple coverage under the scheme, the cover will be restricted to Rs. 2.00 Lakhs and other insurance covers are terminated and premium shall be forfeited.

Read also other related article:

The official website of the scheme is www.jansuraksha.gov.in.

National Toll-Free No – 1800-180-1111 / 1800-110-001

StateWise Toll free number are listed in the document attached Statewise Toll-Free (pdf)

Highlights of the scheme Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY - Scheme 2 - for Life Insurance cover)

The scheme will be a one year cover, thereafter renewable every year. The scheme known as Pradhan Mantri Jeevan Jyoti Bima Yojana, would be offering life insurance cover for death due to any reason. The scheme would be offered / administered through Life Insurance Corporation of India (LIC) and other Life Insurance companies willing to offer the product on similar terms with necessary approvals and tie up with Banks for this purpose. Participating banks will be free to engage any such life insurance company for implementing the scheme for their subscribers.

Eligibility - All savings bank account holders of the Participating Bank in the age group between 18 years (completed) to 50 years (age near birthday) who have given consent to join the scheme / enable 'Auto Debit' as per the modality, will be enrolled into the scheme.

Enrollment Modality / Period - The cover shall be for the one year only starting from 1st June to 31st May for which option to join / pay by 'Auto Debit' from the designated savings bank account on the prescribed form will be required to be given by 31st May of every year, extendable up-to 31st August. Those joining subsequently may be able to do so with payment of full annual premium for prospective cover, with submission of a self-certificate of good health in a acceptable form.

Premium - Rs 330/- per annum.

Payment Mode - The premium will be directly 'Auto-Debit' by the bank from the subscribers' savings bankn account. This is the only mode available currently.

Risk Coverage - Sum Assured of Rs. 2,00,000/- on the death of the Insured member for any reason is payable to the Nominee. No claim is admissible for deaths during the first 45 days from the entry date, except for the cause of death due to accident.

Termination of assurance -

1) Account holder attains age of 55 years.

2) Closure of account with the Bank or insufficiency of balance for debiting premium.

3) In case of multiple coverage under the scheme, the cover will be restricted to Rs. 2.00 Lakhs and other insurance covers are terminated and premium shall be forfeited.

Read also other related article:

The official website of the scheme is www.jansuraksha.gov.in.

National Toll-Free No – 1800-180-1111 / 1800-110-001

StateWise Toll free number are listed in the document attached Statewise Toll-Free (pdf)

Posted on: 13/05/2015 10:40:00 PM